MAF SMALL LOANS SCHEME

Petty trading has been identified as the backbone of most households in Africa and Ghana for that matter for several generations. These small-scale trading activities have contributed immensely to providing shelter, food, cloths, and funds for the education of most Ghanaians particularly in rural areas. The situation is no different in Sirigu and surrounding communities. For several generations, petty trading has been the lifeline of households in these communities. All trading activities are centred in and around the central market square and usually intensify on market days.

However, despite the invaluable role petty trading plays in the very existence of households in these communities, the age-old business has and continue to suffer serious challenges that result in traders folding up their businesses. Chief among the challenges is access to capital for operations, and growth. Even though the capital requirement to successfully operate a petty trading business is usually small, access to these funds has and continue to be the bane of petty traders. The problem is even worse in the context of petty traders in rural communities who do not have access to formal financial services. Petty traders usually require very little financial support for routine procurement of their wares to speed up their trading activities within controlled thresholds.

Female petty traders have been discovered to be the most affected because of their natural unfair position in society. The situation is no different among female petty traders in Sirigu and surrounding communities. For decades, petty traders in these communities have had to endure very difficult challenges when seeking funds for their trading. Many have had to borrow from friends, relatives, and unscrupulous money lenders at exorbitant interest rates. The majority who do not have access to such sources of funds are forced to close their trading activities at the least market disruption.

Thus, considering the invaluable role of petty trading in supporting households in Sirigu and adjoining communities and the fact that Mother Akandiga was at some point a petty trader herself, the foundation resolved to institute the small loans scheme to support female traders in the communities. The rationale for instituting the small loans scheme for petty traders in Sirigu and adjoining communities is to help ease the difficulty in accessing funds for business operations and growth.

The small loans scheme is a MAF sponsored project aimed at promoting commerce in Sirigu and adjoining communities. Essentially, the initiative seeks to provide interest free small loans to petty traders and artisans in these communities to improve their business operations and subsequent growth. The foundation believes that the initiative will help scale up trading activities in communities as well as job creation and improved standard of living.

The primary objective of the initiative is to promote and deepen commerce in the Kasina Nankana East District through a comprehensive small loans scheme for petty traders in Sirigu and adjoining communities. To achieve this, the foundation seeks to execute the following specific objectives:

- To provide interest free short-term loans to women/female petty traders and artisans in Sirigu and adjoining communities,

- To train beneficiary traders in entrepreneurship and basic bookkeeping,

- Provide the required tools and materials that will enable all trainees under the foundations skill development programme to start their own businesses at the end of the training,

- The foundation will also provide business advisory and mentorship services to all beneficiaries of the loans scheme,

- To strategically graduate or increase the loan amount from an initial five hundred Ghana cedis (GHC500.00) to a maximum of ten thousand Ghana cedis (GHC 10,000.00) over time. This will only apply to beneficiaries with a good repayment history,

- To ensure that a minimum of 600 petty traders in Sirigu and adjoining communities benefit from the interest free loan scheme within the next 24 months of operation.

The Loan Threshold

Basically, the interest free short-term loans to be issued to female petty traders and artisans will commence with a maximum of Five hundred Ghana cedis (GHC 500.00). The amount will be increased to a maximum of ten thousand Ghana cedis (GHC 10,000.00) overtime. However, increases in the amount issued to a beneficiary trader is subject to how punctual the individual trader repays previous loans taken.

Eligibility Criterion

Eligibility Criterion for Existing Petty Traders and Female Artisans

The following are the key requirements that must be met to qualify for the loan facility:

- The applicant must be a woman,

- Applicant must be 50 years old and above,

- Must be an active petty trader for at least one year,

- Must hail from Sirigu or the immediate adjoining communities,

- Applicant must trade in goods and or services that are legal under the laws of Ghana.

MAF Trades & Vocation Project

All beneficiaries of the project automatically qualify for the loan scheme. However, the following are additional requirements to meet:

- Must have completed and passed the skills training program,

- Must be between the ages of 14 and 49 years,

- Must have demonstrated a high level of seriousness in self-employment during training,

- Applicant must present evidence of recommendation from their master trainers,

- Applicant must present a guarantor and complete the guarantor’s form.

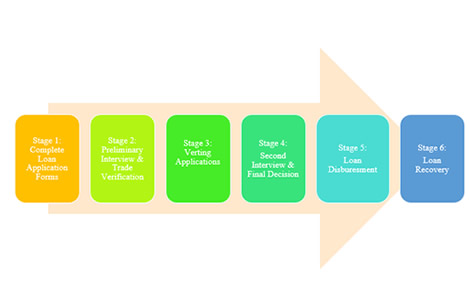

Loan Application Process

All eligible petty traders in the beneficiary communities will be required to complete and submit for processing a loan application form. The applicant will also be required to bring along a guarantor and complete the guarantor application form. Guarantors are to help the loan recovery team in the event of a repayment default by the borrower. All applications will be assessed and verted by the loans officer before onward referral to the small loans Project Manager for final approval.

The assessment includes preliminary interview of applicants, a physical inspection of the applicants’ place of business or trade to confirm the existence of the trade and the type of goods and or services the applicant is into. The team will also visit the place of residence of both the applicant and the guarantor (if they both reside in different houses). Once satisfied with the inspection of the business and place of residence of the applicant, the loans officer will go ahead to select the applications that qualify for consideration.

All applications will be reviewed based on a ‘first-come-first-serve’ policy. The foundation will work towards approving a maximum of twenty-five (25) loan applications per month until the first batch of 500 applicants are served.